The number of Bitcoin wallets holding 100 BTC or more has surged to a 17-month high, driven by increased “hodling” in the past month. Data from blockchain analytics platform Santiment, shared in an Aug. 31 post on X, shows that 283 wallets crossed the 100 Bitcoin mark during August.

“As crypto prices disappoint retail traders, the number of Bitcoin whales is increasing. A net gain of 283 wallets holding at least 100 BTC has appeared in just one month,” Santiment noted. “There are now 16,120 such wallets on the network, reaching a 17-month high.”

Santiment also reported an uptick in wallets holding at least 10 Bitcoin, often referred to as “sharks.” These wallets have been accumulating more Bitcoin alongside the whales.

In total, wallets holding between 10 and 10,000 Bitcoin have collectively added over 133,000 coins, worth more than $7.6 billion in just 30 days.

Whales Increase Buying as Smaller Traders Exit

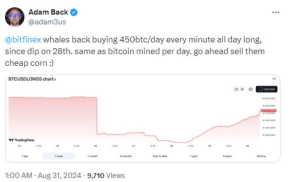

Adam Back, CEO of Blockstream and creator of Hashcash, pointed out that Bitcoin whales have been on a buying spree since the price dropped from over $62,000 to around $58,000 on Aug. 28.

“Whales are buying 450 BTC per day, every minute, all day long, since the dip on the 28th. That’s the same amount of Bitcoin mined daily. Go ahead, sell them cheap,” Back commented.

Santiment believes the surge in whale activity is due to smaller traders “impatiently” selling their holdings to larger buyers. Crypto analyst Axel Adler Jr, a contributor to CryptoQuant, speculated in a Sept. 1 X post that smaller traders may feel pressured to sell as the price drops below their entry point.

“In the current bull market, the metric hasn’t fallen below 17%. Right now, it’s at -8%. If this continues to drop, the number of people willing to sell at a loss could double,” Adler explained.

Meanwhile, the Crypto Fear & Greed Index, which tracks market sentiment, was in the “Fear” range at 26 on Sept. 2. August saw more fear than greed in the market, with an average index rating of 37.

Despite this uncertainty, Bitgrow Lab founder Vivek Sen believes the rise in whale activity could be a positive sign for Bitcoin. He pointed out that historically, significant whale buying has often been followed by new all-time highs for the cryptocurrency.

“The last time whales bought heavily, Bitcoin hit a new ATH (All-Time High),” Sen remarked.

Source: https://cointelegraph.com/news/bitcoin-whale-wallets-hit-17-month-high?

_________________

Disclaimer: “The articles on this website reflect the opinions of the respective writers and are not the opinion of Museigen.io. In addition, nothing in this article should be considered as financial advice. It is essential to conduct your independent research and consult with a qualified financial advisor before making any financial decisions.”